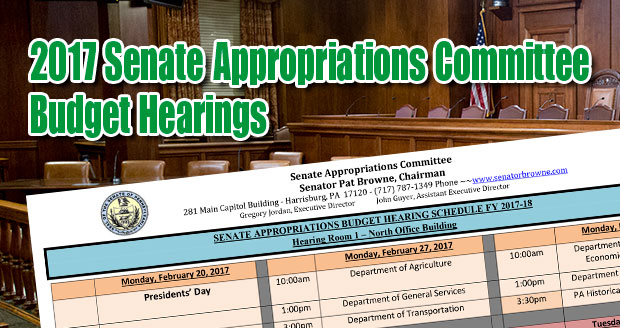

Budget Hearings Summary – 2017

Watch all of the budget hearings from 2017 here.

A daily summary of budget hearings, with key issues and hearing video.

Agriculture

Monday, February 27

Members of the Senate Appropriations Committee questioned Agriculture Secretary Russell Redding about major cuts that have been proposed this year in programs that have been historically supported by the General Assembly. Questions focused on:

- The governor’s proposal to eliminate funding for the University of Pennsylvania’s School of Veterinary Medicine given the significant role it plays and that fact that it is the only school of veterinary medicine in the Commonwealth

- Funding cuts for agricultural research, flat funding for conservation districts and the impact this would have on the protection of water quality and other areas.

- Concerns about the Governor’s proposal to enter into a lease-leaseback arrangement for the Farm Show Complex and the lack of data to evaluate the plan.

- Increasing state costs because fewer counties and municipalities are operating their own weights and measures programs and food safety inspections

- The increase in dog license fees and the diversion of that money for unrelated programs.

- Farmland preservation and how planned pipelines will affect the program.

- The better promotion of industrial hemp, which is a major PA product.

- The role the department will play in regulating growers of medical marijuana.

- Increased cases of chronic wasting disease and how it is impacting deer herds.

- The difficulty in maintaining a labor force to work in the agriculture industry.

- Whether Pennsylvania is meeting its obligation to comply with EPA requirements involving the cleanup of Chesapeake Bay.

- The PA Preferred Program and the fact that it is not self-sufficient.

- Managing water quality in an economically feasible way for farmers.

- The financial viability of the State Racing Fund over the long term.

Attorney General

Wednesday, February 22

Members of the Senate Appropriations Committee questioned Attorney General Josh Shapiro on several law enforcement issues including:

- Efforts to crack down on drug traffickers and address the growing opioid epidemic.

- The need to provide treatment and rehabilitation for non-violent offenders, rather than incarceration.

- How funding will impact state efforts to crack down on child predators.

- The effectiveness of mandatory sentences, particularly for drug kingpins.

- Legal and other obligations encumbered as a result of the actions of Attorney General Kane.

- The need to restore trust and morale in the office and to rebuild the agency.

- Whether counties are receiving the full reimbursement that they are entitled to for full-time district attorneys.

- Improving the relationship between the department and all levels of law enforcement.

- An analysis of technology needs and how they can improve law enforcement efforts.

Auditor General

Wednesday, February 22

Auditor General Eugene DePasquale discussed a variety of issues pertaining to state and municipal pensions during a hearing with members of the Senate Appropriations Committee. Other topics of conversation included:

- Preventing the abuse of public assistance programs.

- The benefits of competitive bidding for transportation projects.

- The upcoming audit of SIIF funding for the Unemployment Compensation system.

- Use of state-owned and leased office space.

- Problems identified in school district audits.

- Information Technology upgrades completed in recent years and the cost of upgrades.

- The results of recent audits of charter schools.

- Examination of drug treatment programs and options.

Budget Secretary/Sec. of Admin/Gov’s Executive Office

Thursday, March 9

The committee held an extensive discussion of the Governor’s Budget Office/Executive Offices/Office of the Governor with Budget Secretary Randy Albright and Secretary of Administration Sharon Minnich. Issues discussed during the hearing included:

- Updated revenue estimates.

- The array of tax increases proposed by the Governor.

- Proposed elimination of certain sales tax exemptions.

- Feasibility of using long-term borrowing for short-term expenditures.

- The Governor’s proposed tax credit cap.

- Records management and retention.

- Implementation of the Civil Service Modernization Act.

- The Governor’s proposed Lease-Leaseback of the Pennsylvania Farm Show facility.

- The proposed elimination of funding for the University of Pennsylvania School of Veterinary Medicine.

- Efforts to combat opioid abuse.

- Reduction in funding for scholarships for private colleges.

- Maintenance of service under the proposed Department of Health & Human Services.

- Use of an outside contractor to develop cost saving and budgetary recommendations.

- The need to address public pension costs.

- The Governor’s moratorium on expanding KOZ and CRIZ.

- The expected number of workers who would take the proposed early retirement incentive and the projected cost savings.

- The proposed $25 per capita fee for State Police coverage.

- Upcoming labor contract negotiations.

- Layoffs and other issues related to the Unemployment Compensation Service Centers.

- Gaming expansion.

- The proposed merger of Aging, Drug & Alcohol Programs, Health, and Human Services departments.

- The proposed Marcellus Shale severance tax.

- Statewide health care contract for school districts.

- Costs of and quality of life in state veterans’ homes.

- The continuing and costly statewide radio system efforts.

- Sales of state properties.

Corrections/Probation and Parole

Thursday, March 2

Secretary of Corrections John Wetzel and Chairman of the Board of Probation and Parole Leo Dunn answered questions during the hearing for the proposed Department of Criminal Justice, merging the Pennsylvania Department of Corrections and the Pennsylvania Board of Probation and Parole.

- The need to provide more community input and openness in the public process of closing prisons.

- An update on the reduction in prison populations and high recidivism rates – roughly 60 percent.

- The experience other states that combine corrections and probation and parole.

- Making changes to the way technical parole violators are treated.

- The potential need for future prison closings.

- Reducing high employee turnover rate.

- Costs associated with mandatory overtime, particularly in light of 122 current vacancies, and how they impact pensions.

- Cost-saving measures being implemented through technology, health care and other means.

- The use of mandatory-minimum sentences and how they are imposed, particularly in cases of violent crimes and drug offenses.

- A $10 million cost for union-negotiated “walk time” – the cost of compensating guards from the time they leave their post until they leave the prison.

- The use of boot camps for non-violent offenders.

- Using risk assessments to transition non-violent offenders back into the community.

DCED (Department of Community and Economic Development)

Monday, March 6

The committee questioned Secretary Dennis Davin about the proposed 9.1 percent decrease in DCED funding, as well as:

- The economic development opportunity presented by the SCI Pittsburgh closure.

- The proposed Apprenticeship Grant Program.

- The proposed $6.1 million PA tourism initiative.

- The proposed Smart Cities transportation planning initiative and the need to apply it to more than cities.

- The Manufacturing Training-to-Career Grant Program.

- Borrowing money to fund proposed new grant programs.

- Update on Act 47 efforts for distressed municipalities.

- Beneficiaries of Small Business Development funding.

- The Governor’s opposition to expanding Keystone Opportunity Zones and City Revitalization and Improvement Zones.

- The proposed $2 million cut in Partnerships for Regional Economic Performance (PREP).

- The economic impact of the southwestern PA cracker plant and southeastern PA natural gas processing.

- The impact of the Life Sciences Greenhouse initiative.

- Conflicting job creation numbers from DCED and the Labor and Industry Department, and a breakout of jobs created versus jobs retained.

- The lack of legislative input into individual tax credits being grouped into the proposed Tax Credit Block Grant.

DCNR (Department of Conservation and Natural Resources)

Wednesday, March 1

Senators asked Secretary of the Department of Conservation and Natural Resources Cindy Adams Dunn a number of questions about programs and services provided by the agency, including:

- Concerns about the use of bond money for ongoing operations, the long-term costs that will be incurred, and how future services could be impacted.

- The effectiveness of pilot programs aimed at reducing farmland erosion and protecting the Chesapeake Bay watershed.

- The results of a three-part audit of royalties received from oil and gas well leases.

- Reusing abandoned coal mine sites for recreational activities, including ATV trails.

- Pennsylvania’s decision to not charge entrance fees to state parks.

- Boosting revenues from timber sales and how timbering is managed.

- A reduction in the department’s employees and the impact on service.

- The department’s online system for renting cabins in state parks.

- A new fee structure for various park services.

- The success of the state’s Growing Greener Program and efforts to pass Growing Greener III legislation to meet additional park and recreation needs.

- Working to address impaired streams and improve water quality and engaging landowners in the process.

- Replacing older buildings with energy-efficient structures to reduce costs and become greener.

- Boards and commissions that come under the supervision of DCNR.

- The economic benefit of parks, trails and heritage areas.

DEP (Department of Environmental Protection)

Thursday, March 9

Acting Secretary Patrick McDonnell was questioned about DEP’s proposed general operating budget, which totals $13.5 billion, a 3.4 percent decrease. Topics included:

- Ongoing delays in issuing DEP permits.

- The possible use of outside consultants to review permits.

- Permit processing for pipelines that stretch across regions.

- Details on the $45 million DEP, Department of Agriculture, and Department of Conservation and Natural Resources water quality plan.

- Proposed natural gas severance tax effect on community impact fee funding.

- Estimate of remaining waste tire piles after 20 years of the Waste Tire Recycling Act.

- The West Virginia NPDES permit model for mid-sized development projects.

- State borrowing to finance DEP operations.

- Regulatory obstacles delaying job-producing projects for years.

- Pennsylvania’s spending of $180 million in state and federal funds on Chesapeake Bay regulations over three years.

- The use of Pennsylvania’s portion of Volkswagen settlement money on diesel emissions issues.

- The Administration’s development of a plan to mandate that energy production include 10 percent solar energy by 2030.

- The EPA report on unaddressed safe drinking water violations in Pennsylvania.

- Homeowners sharing wells impacted by DEP regulations designed to cover public water systems.

- Adequacy of the Black Fly spraying program.

- Regulation of high hazard dams.

- Municipalities imposing MS4 fees on property owners for impervious surfaces.

- The Covered Device Recycling Act and TV sets being dumped on roadsides.

- Reduced funding for the Hazardous Sites Cleanup Act.

- DEP efforts to reduce recyclable glass going into landfills.

- Multiple DEP restricted accounts and special funds facing insolvency.

- Coal refuse cleanup efforts.

- The growing challenge of local stormwater management.

- Continued problems with DEP not being business-friendly.

- New methane permitting thresholds.

- Payments to Delaware River Basin Commission.

- Pennsylvania’s progress in meeting Chesapeake Bay water quality requirements.

- Air quality study release date.

- Length of GP5 permit applications.

- How Pennsylvania environmental regulations became more stringent than federal requirements.

DGS (Department of General Services)

Monday, February 27

DGS Secretary Curt Topper discussed the Governor’s proposed appropriation for his department, which is 3.1 percent lower than for 2016-17. Also discussed were:

- Plans for savings through procurement.

- Energy consumption and savings.

- DGS work with the Office of Administration.

- The Farm Show Complex leasing proposal.

- Efforts to reduce vehicle fleet size and manage transportation costs.

- Capitol building security and the recent incident of vandalism.

- Reductions in the use of state real estate holdings.

- The financial return using sole source contracts.

- Update on sale and transfer of former SCI Cresson property.

- The need to update antiquated laws governing sale of government property.

- The quality of the DGS IT system.

- Budgeted upgrades at the Farm Show Complex.

- Difficulty in disposing of surplus government properties.

Education

Tuesday, Mar 7

Secretary of Education Pedro Rivera fielded questions on the department’s policy priorities and budget request, which calls for an increase of $100 million in basic education funding, and for a total of $13.6 billion for both basic education and higher education, which represents 42 percent of the entire Commonwealth budget.

Topics discussed included:

- The distribution of funding across 500 school districts and SSHE colleges, and the disparity in teacher salaries, pensions, per-pupil spending, building quality, and more.

- The need for pension reform and its impact on school funding.

- Developing college and career readiness plans, incentivizing career and technical schools, matching curricula to work force trends, and the movement toward four-year degrees.

- The proposed $50 million cut to bus transportation programs, the impact on rural districts, and the effect of the rising fuel costs.

- Ways to improve the teacher evaluation system (Act 82).

- Proposed changes to the School Performance Profile, to account for growth.

- The work toward property tax elimination.

- The feasibility of merging school district health care and pharmacy plans.

- Cyber-charter schools’ quality and delays in charter renewals.

- The status of the Plan Con review and school construction projects now in progress.

- The future of the Education Improvement Tax Credit (EITC).

- Difficulties with data collection, and the lack of current data.

- The proposed 50 percent cut to private college institution grants and its impact on lower-income students.

- Student loan debt and the role of community colleges in saving student tuition costs.

- Negotiating for sick and bereavement leave in collective bargaining agreements.

- The number of employees eligible for the proposed early retirement buy-out.

Health and Human Services

(Proposed consolidation of Aging, Drugs & Alcohol, and Health departments)

Wednesday, March 8

Part 1

Part 2

Testifying were Secretary of Human Services Ted Dallas, Aging Secretary Teresa Osborne, Acting Secretary for Drugs and Alcohol Jennifer Smith, Health Secretary Dr. Karen Murphy, and Physician General Dr. Rachel Levine. The Governor is requesting $39.2 billion for the four merged departments. The following topics were addressed by the committee:

The following topics were addressed by the committee:

- The process and aftermath of the proposed consolidation of four departments, including the ambitious timeline, the ultimate leader, the net employee complement, the savings on personnel and the impact of early retirement, and the possible diminished focus on aging

- Efforts to curb waste, fraud and abuse in the Departments of Health and Human Services and the role of the Office of Inspector General

- Contacts to consumers who passed away and the failed technology that spawned errors

- Increasing purchasing power on pharmaceutical purchases, including in PACE and PACENET, to save money in the Lottery Fund, and the drop in the dispensing fee

- The future sustainability of the Lottery Fund

- The proposed closure of state Health Center facilities, Norristown State Hospital and Hamburg State Center in a move from institutionalization to community-based care, with concerns for not just the residents but the vacant building

- Consumer access to county assistance offices after opening regional processing centers

- Timeline and added cost of Health Choices roll-out delays due to bid protests

- The status of the Aging waiver, the MAXIMUS contract and full competitive bidding

- The consequences of Affordable Care Act “repeal and replace” changes on the horizon at the federal level and the eligibility for Medicaid expansion

- The Public Health Fund and our readiness to respond to a health crisis such as Zika Virus, Ebola or Lyme Disease

- Heroin addiction initiatives, especially for special populations, including veterans, pregnant women, women with children and the LGBT community

- The need for an ombudsman program

- Increasing nursing home beds and the rise in complaints about quality of care

- The effectiveness of treatment for heroin addicts and the “warm hand-off” of Narcan-resuscitated patients, along with recovery support services to prevent relapse

- Statewide treatment protocols for heroin treatment, and overdose locations

- The new Prescription Drug Monitoring Program and its role in addiction prevention

- Staff turnover, salary freezes, and employee burnout in direct care workers

- The notification of changes in Medicaid waivers and the impact on local sheltered workshops for the visually impaired and others; the “pigeon-holing” of workers

- Chronic renal disease program as a last resort for billing

- The DHS decision not to fund the waiting list

- The link between autism and vaccines, and the growing autism caseload

- The status of Medical Marijuana regulations on growers and processors

- Regional cancer centers, which were zeroed-out for funding

- The “I Want to Work” campaign and gainful employment opportunities for those with disabilities

- Zeroed-out funding for bio tech research and tobacco settlement dollars

- Plans to rein in costs of Medicaid

- The growing number of doctors who are refusing to take Medicaid patients.

- Whether patients who are receiving life-saving antidotes for overdoses have responsibility to pay for the medication

- Concern that drug and alcohol programs would be diminished and moved down the list of priorities in a larger agency.

- Attempts to modernize the antiquated system of obtaining vital records.

- Whether child protective services would be considered “essential services” in the case of a budget impasse.

- An update on the STARS system which is used to rate providers.

- Efforts to implement the state’s medical marijuana program and ensure that it is safe and effective.

- Contingency plans that are in place in case anticipated savings are not realized in PACE program.

- Sharing data with the Department of Military and Veterans Affairs on the services that are available to help seniors age in place.

- How the Governor’s plan to raise the minimum wage would impact service providers and direct care workers.

- Concerns by senior citizens about losing their voice if the Department of Aging is folded into a larger agency.

- The importance of a continuum of care for senior citizens in assisted living facilities.

- Meeting the long-term care needs of veterans.

- The important role that sheltered care workshops play in the quality of life for people with special needs and the need to involve families in choices.

- Costs associated with implementing the medical cannabis program and whether it will be self-sustaining.

Historical and Museum Commission

Monday, March 6

Senators asked James Vaughn, Executive Director of the Pennsylvania Historical & Museum Commission, about the agency’s budget and mission, including:

- Digitization of the state archives and records.

- Balancing historic site preservation with economic development.

- The proposed allocation of $2 million from the Pennsylvania Economic Revitalization Fund for cultural and historic support.

- The planned new archives and record center in Harrisburg.

- Site maintenance.

- Use of revenues generated from fees.

- Trends in attendance at historical sites and museums.

- The 36-percent cut in state funding over the past 10 years.

- Marketing and the use of social media.

Independent Fiscal Office

Tuesday, February 21

Independent Fiscal Office (IFO) Director Matthew Knittel briefed the committee on the economic outlook for the coming fiscal year as well as debt levels and general revenue trends. Committee members focused on the following topics:

- The short-term and long-term budget impacts of public pension costs and debt.

- Projected economic activity and job growth in the state over the next several years.

- Revenues from the Marcellus Shale Impact Fee and the Governor’s proposed severance tax.

- The impact of a minimum wage increase on employment and state revenues.

- Differences in projected business tax and personal income tax revenues by the Administration and the IFO.

- The proposed expansion of the sales and use tax.

- Challenges created by a potential move to performance-based budgeting.

- Lottery and gaming revenues and funding of programs and services for senior citizens.

- Impact of the Governor’s proposed net operating loss cap.

Judiciary

Tuesday, February 28

State Supreme Court Justices Christine Donohue and Sallie Updyke Mundy answered questions on a variety of issues related to Pennsylvania’s court system including:

- Effectiveness of specialty/problem solving courts.

- Cost saving measures adopted by the judicial branch.

- Specific judicial committees.

- Statewide uniform judicial system measures and initiatives.

- Consolidation of offices and reductions in district justice positions.

- Probation violations.

- Utilization of office space in the state Judicial Center.

- The impact of the opioid epidemic.

- Mandated sentencing.

- A proposed increase in common pleas judges.

Labor and Industry

Tuesday, February 28

Lawmakers expressed frustration about persistent problems with the Unemployment Compensation system during a hearing with Department of Labor and Industry Secretary Kathy Manderino. Other topics of discussion included:

- How funding dedicated to the Service and Infrastructure Improvement Fund was allocated.

- The amount of funding lost to overpayments in Unemployment Compensation.

- The impact of additional layoffs for individuals serving the UC system.

- The criteria used in deciding which UC call centers were closed.

- The five-fold increase in wait times for UC callers in January 2017.

- Ways to reduce duplication of services in job training programs.

- Ongoing support for the Strategic Early Warning Network program.

- How calls to UC call centers are assigned to representatives.

- The potential need for additional funding for the Bureau of Occupational and Industrial Safety.

- The cost of all necessary IT upgrades for the entire department.

- Steps to make the State Workers’ Insurance Fund more user-friendly.

- The Wolf Administration’s proposal to boost the minimum wage.

- The number of employees covered by collective bargaining contracts.

Liquor Control Board

Thursday, March 2

Representatives from the Pennsylvania Liquor Control Board outlined the positive impacts of the modernization measures approved by lawmakers last year. Other topics discussed during the hearing included:

- The impact on statewide wine sales resulting from the increase in the number of wine retailers.

- The increase in the number of state-owned liquor stores open on Sundays.

- Inflated costs paid by the state for top-shelf liquor.

- Warehouse and transportation costs incurred by the wholesale system.

- Concerns about operating costs outpacing sales growth.

- The bidding process for auctioning licenses.

- The number of state stores that are losing money.

- Management and organizational structure of PLCB.

- Liquor law enforcement.

Military and Veterans Affairs

Wednesday, Mar 1

Brigadier General Anthony Carrelli, the Adjutant General, joined by four other military officials and a budget analyst, fielded questions on the DMVA’s $374.7 million budget request.

The following issues were discussed:

- The current number of Guard members deployed and future deployments expected.

- The financial stability of the Veterans Trust Fund, which now has a $2.2 million balance, and the need for more revenue sources.

- The need for $500,000 more for Veterans Outreach.

- The size of the Veterans Registry, as it aims to serve Pennsylvania’s 900,000 veterans.

- The possibility of adding to the six veterans’ homes and expanding geographic reach in underserved areas by either opening a new state home or partnering with county homes.

- The relative cost of operating veterans’ homes compared to civilian nursing homes, with veterans’ homes running at double the cost.

- The move toward the privatization and out-sourcing of services (food and custodial) in some veterans’ homes.

- The solvency of the Veterans Education Assistance Program.

- The effect of the federal defense budget on Pennsylvania in terms of jobs, infrastructure, our armories, transportation, equipment, and funding.

- The establishment of veterans’ courts in 20 counties and the practicality of expanding to all 67 counties.

PEMA/Fire Commissioner

Thursday, March 2

PEMA Director Rick Flinn, Executive Deputy Jeff Thomas, Deputy Boyle, and Fire Commissioner Tim Solobay fielded questions about emergency response.The following topics were discussed:

- The effects of the 911 re-write/re-authorization and the modernization and consolidation of Public Safety Answering Points (PSAPs).

- The level of collaboration with the State Police on Next Gen 911 and the P25 system, and with DCNR on the GIS mapping project.

- The number of applications for the volunteer firefighter grants.

- The rate of participation in PennFIRS (Fire Information Reporting System) program

- The need for a “reboot” of Senate Resolution 60 to attract and retain new firefighters, including online training for volunteer firefighters, as called for in SR 6.

- Support for legislation to allow fireworks sales in Pennsylvania, with proceeds directed to firefighter recruitment.

- The status and functionality of the new PEMA headquarters.

- The elimination of funding for search and rescue operations.

- Trends in the numbers and ages of volunteer firefighters, and the need for more incentives.

- PEMA as the lead agency in the event of a four-department health/aging/drugs and alcohol/and human services consolidation.

- The adequacy of funding for disaster relief and hazard mitigation funding.

- The long-overdue rewrite of Title 35 and the need for worker’s compensation coverage for dually enrolled personnel who get injured on the job.

PSSHE (PA State System of Higher Education)

Thursday, February 23

State System of Higher Education Chancellor Frank Brogan updated the Appropriations panel on the status of the 14 universities and challenges they are facing. Discussion focused on:

- The declining enrollment in many of the state universities.

- An ongoing study to determine how to sustain the viability of the State System, boost enrollment and improve operations.

- Faculty requirements for teaching, advising and other duties.

- The cost of maintaining facilities that may not be in use.

- The debt load being carried by each university.

- Online universities and their impact on the State System.

- Assisting families and students in pursuing the appropriate degree choices.

- How universities advertise and market their particular institutions.

- Alumni contributions and how they impact budgets.

- The rising cost of tuition and the amount of debt incurred by parents and students.

- Salary increases for faculties versus the rate of inflation.

- Educational opportunities for veterans and programs available to them.

- Lower graduation rates.

Revenue/Lottery

Monday, March 6

Revenue Secretary Eileen McNulty fielded questions regarding the Wolf Administration’s proposed cuts to various tax credit programs and the $1 billion in new taxes requested by Governor Wolf. Other topics of discussion included:

- The projected impact of gambling expansion proposals on Lottery sales.

- Increases in Lottery sales from instant games.

- Potential environmental impacts that would result from a reduction in tax credits.

- Concerns regarding potential cuts in the number of communities eligible for the KOZ program.

- The effect on ratepayers if the Administration’s insurance premiums tax is enacted.

- Legal issues pertaining to tax collection for medical cannabis.

- How the Administration’s proposed commercial storage tax would impact businesses.

- Revenue lost by the state due to tax increases enacted at the local level.

- How the pending state Supreme Court case regarding net operating losses could affect small businesses.

- Cyber security and the Department’s efforts to protect personal information.

State

Wednesday, February 22

The committee questioned Secretary Pedro Cortes about plans to increase the number of registered voters by 75,000, along with the following topics:

- Online business registration.

- Salary and benefit costs and employee contributions.

- The length of time to conduct professional licensure complaint investigations.

- Staffing levels and vacancies.

- Voter fraud by people coming from other states.

- The SURE system and integrity of county voter rolls.

- Pennsylvania’s involvement with the Electronic Registration Information Center (ERIC).

- Publishing legal notices in print media vs. online media.

- Pennsylvania’s status as the only state to use digital signature upload feature for online voter registrations.

- Record-high complaints filed with department.

- Ensuring enough modern voting machines in 2020.

- The low number of campaign finance reports being filed online.

- Bureau of Corporations and Charitable Organizations contribution to the General Fund.

State Police/Homeland Security

Thursday, February 23

Col. Tyree Blocker discussed their 2017-18 request of $1.272 billion. The following topics were discussed:

- The use of body cameras, audio and video recording of interviews and other emerging technologies in training and policing.

- The heroin epidemic and cooperative intelligence gathering to crack down on drug trafficking.

- The use of naloxone to reverse heroin overdoses, with 70 successful saves.

- Staffing complement, attrition through retirements, and succession plans to get to the 4,719 authorized complement

- The fairness and relationship to actual costs of the $25 per capita fee for municipalities that rely on State Police coverage alone, along with the possible use of a population threshold to calculate fees.

- The failed statewide radio project and ability to recover costs for a $1 billion project that never fully worked, due to terrain and other factors

- The use of radar by local police.

- The use of drug seizure money.

- The use of General Fund dollars versus Motor License Fund dollars under Act 89 for police budgeting.

- The redeployment of troopers for gaming and other policing duties.

State Related Universities

Wednesday, Mar 1

Presidents and Chancellors of Pennsylvania’s state-related universities discussed the challenges facing their schools during a budget hearing with members of the Senate Appropriations Committee. Other topics of discussion included:

- Rising tuition costs and student loan debt.

- Potential changes in curriculum based on economic trends and student needs.

- Targeted goals for cost savings at each university.

- Projected tuition increases next year.

- Efforts to promote financial literacy among students.

- Four-year and six-year graduation rates.

- Allocation of medical center spending.

- Percentage of faculty that choose a defined contribution pension plan instead of a defined benefit plan.

- The proposed reduction in PHEAA grants.

- Tuition differences at branch campuses.

- The impact on pension systems resulting from early retirement incentive packages.

- The cost of advanced technical degrees.

- PHEAA grants for students who complete all coursework online.

Transportation

Monday, Feb 27

Transportation Secretary Leslie Richards fielded questions on the department’s proposed budget and ongoing efforts to improve Pennsylvania’s roads and bridges. The hearing included questions on the following:

- An update on Act 89 – the Transportation Funding Act – and a progress report on projects that have been completed.

- The need to speed up the grant process, particularly for multi-modal projects.

- The effectiveness of Public Private Partnerships in Pennsylvania and on a national level.

- A new emissions inspection program and the cost to small stations.

- Proposed legislation that would exempt newer vehicles from emissions testing and the dichotomy of testing in different areas.

- The use of Project Labor Agreements in transportation projects, whether they increase overall costs, and if non-union companies would be excluded.

- The impact of the governor’s early retirement proposal on department operations.

- A statewide initiative to improve smaller roads that have not been paved for many years.

- An assessment of the department’s information technology systems.

- The importance of aviation in the transportation network.

- Reviewing formulas used to distribute liquid fuels money.

- Unnecessary delays in transportation projects as a result of environmental studies.

- Efforts to reduce litter along interstates.

Treasury

Tuesday, Feb 21

The Senate Appropriations Committee kicked off three weeks of public hearings on Governor Wolf’s proposed 2017-18 state budget with a review of the State Treasurer Joe Torsella’s budget request. Topics covered included:

- Merging state and municipal pension plan management.

- Merging Treasury special funds to save money.

- The department’s new code of conduct policy.

- The status of ABLE savings accounts for Pennsylvanians living with disabilities.

- State debt and the Governor’s proposed cost savings.

- Proposed Farm Show Complex lease-leaseback.

- TAP Guarantee Program for college savings.

- The possibility of more investment options for pension holders.

- SERS/PSERS staffing levels.

- The need for pension reform.

- Details to justify Treasury staffing request.

- Pension fund investment fees and returns.